Looking back on the development history of global metal two-piece cans, after the golden period of 2003-2014, the industry has been in a break-even environment in the past 4 years, and even a general loss environment. The decline in profits has accelerated the industry’s production capacity to be cleared. From some listed companies According to the data, the capacity utilization rate has increased significantly, laying the foundation for the industry to usher in an upward inflection point. On the other hand, the competition pattern has also improved significantly. From the perspective of Shengxing group’s acquisition of Pacific Packaging and Origen’s proposed acquisition of Ball Packaging, overseas metal packaging companies have gradually withdrawn, and domestic-funded enterprises have entered the industry, with industry CR5 exceeding 60%. The premium and price control ability will be improved.

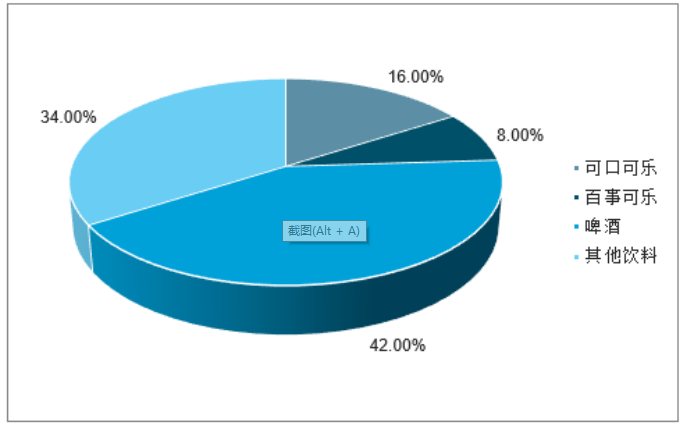

The two-piece cans are mainly beer and aerated drinks. Two-piece cans are mainly aluminum cans. With their cost-effective advantages, they have largely replaced three-piece cans. This is a general trend in the development of global metal beverage packaging. The market size has grown at a compound rate of about 5% in the past five years. However, two-piece cans still have a problem of poor moldability. Therefore, filling gas must be used to maintain the strength of the can. It is especially suitable for carbonated drinks and beer. For non-aerated drinks, nitrogen can be added for use. Adding gas can not change the product taste, so herbal tea and coffee are also gradually used in two-piece cans; while dairy products and functional beverages (such as: Red Bull) still maintain three-piece cans due to quality and taste considerations.

Summary of the areas involved in the downstream of the two-piece can

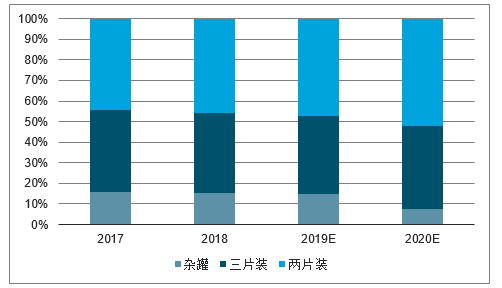

Multi-factor resonance, beer canning rate is in the continuous improvement range. The global beer canning rate in 2017 is about 25%, compared with more than 50% of the canning rate levels in developed countries and regions such as the United States, Japan and South Korea, there is still much room for improvement. The trend of increasing the canning rate will not change: On the one hand, due to the increase in environmental protection requirements, some small and medium-sized glass bottle factories have withdrawn, resulting in a gap in supply, and the price of new bottles has increased due to multiple factors, so beer brands have the ability to increase canning On the other hand, from a marketing perspective, metal packaging is more exquisite, which helps product upgrades.

According to forecasts, benefiting from the steady growth of the downstream food and beverage industry, the continuous increase in the level of beer canning, and the increase in the popularity of canned food, the food and beverage metal packaging industry will continue to experience steady growth in the next few years. It is estimated that by 2019, the total output of the global food and beverage metal packaging industry will reach 131.8 billion cans, achieving a compound annual growth rate of 9.23%.

Total output of the global food and beverage metal packaging industry from 2017 to 2020

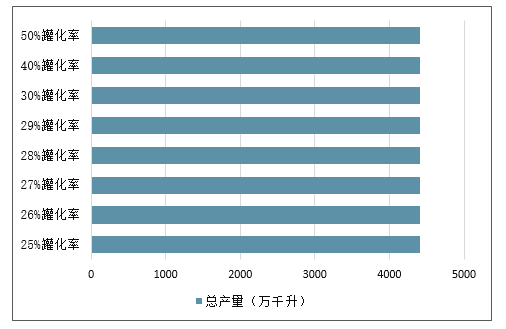

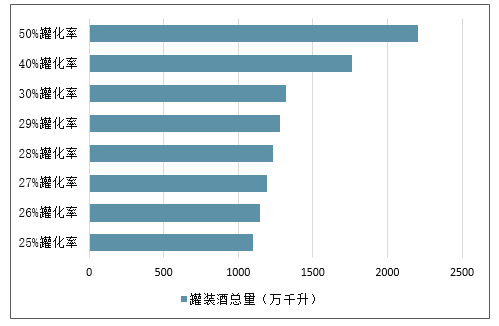

The increase in beer canning rate is driving significant demand for two-piece cans. Calculated based on the historical low price of 0.38 yuan / can, each increase in canning rate by 1 pct can bring about 1.1 billion cans of cans, driving the industry’s demand by about 3 pct. Assuming that the beer canning rate can eventually reach the level of developed countries in Europe and the United States in the future, it will bring more than 10 billion yuan of market space.

Increase of canning rate to calculate the total output of two-piece cans

Estimation of demand for beer cans with increasing canning rate

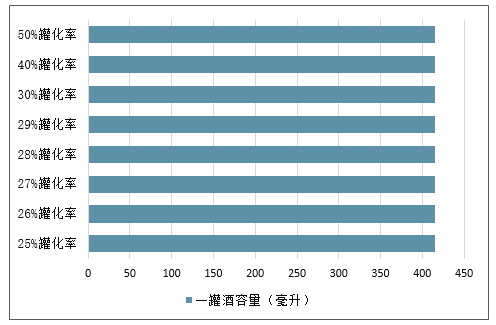

Increase of canning rate to measure the capacity of a can of wine

Estimation of demand for beer cans with increasing canning rate

Future development trend of can making equipment industry

Metal two-piece cans meet price inflection point, performance elasticity is expected

Judging from the data disclosed, the capacity utilization rate of some leading companies has recovered to a historically high level (over 90%), and the competition pattern has significantly improved. Subsequent price increases can be expected: at the point in time, December-February every year is the point where metal packaging and downstream customers focus on bargaining. In terms of flexibility, referring to Bao steel Packaging, the gross profit margin has risen to the highest 18% -20% range in history, corresponding to a single can profit of 0.035 ~ 0.04 yuan per can; It is recommended to pay attention to the metal packaging leader Oerlikon and other A-share and Hong Kong stock metal packaging leaders.

Shaped cans for can making equipment are more popular. At present, in the global market, aerosol cans, beverage cans and food cans are mostly straight cans. Relevant surveys found that in the Asian market, many consumers will choose personalized can packaging equipment shaped cans, rather than monotonous straight cans. Influenced by consumer preferences, the special-shaped cans of personalized packaging will become a trend in the future.

Easy to carry and open. Stretch cans are very common in Asia. Such cans are mostly used as packaging for fish and meat cans. This type of packaging printing mainly uses UV inks. Today, most of these cans have easy-open lids, and can openers are rarely added to the cans. Therefore, simple and convenient packaging is more popular.

Turn three-piece cans into two-piece cans. At present, three-piece cans are mainly used for coffee and juice cans. With the development of the packaging industry, compared to three-piece cans, the production cost of two-piece cans on packaging materials is lower. Reducing production costs will play a vital role in the development of enterprises. In the future, the shift from three-piece cans to two-piece cans will also become a trend.

Pay more attention to security. With the improvement of people’s living standards, food safety issues have received widespread attention. The remove of harmful substances in metal packaging cans has become an important part of food safety risks. Residues of harmful substances such as heavy metals, organic volatiles, solvents, and microbial contamination during the printing of inks are widespread. In addition, bisphenol A is absolutely indispensable in the food packaging industry. Therefore, in the future can manufacturing industry, the safety of packaging materials will also become the focus of consumers.

Flexible digital printing. In recent years, brand owners have increased their demand for package identifiability and personalization. Therefore, the demand for short-term printing will increase significantly. Therefore, higher matching for post-print varnishing and other special post-print processes are also proposed. Requirements. These opportunities will further promote the development of digital printing in the field of metal packaging, enabling metal packaging printing companies to respond faster to the needs of specific customers.

How much is tin can profit? Global metal packaging industry trends in 2020